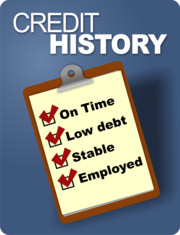

It’s a win-win situation: renovate your home, improve energy efficiency, lower your monthly bills and get up to $5,000 back in an ecoENERGY grant to pay for a portion of it. That’s exactly what the Government of Canada is offering through the ecoENERGY Home Retrofit Program, which was extended June, 6 2011.

In order to qualify for rebates, homeowners must contact a local energy advisor to book their home energy audit. These can be found by calling Service Canada (1-800-622-6232) or conducting a quick Internet search for energy auditors in your area. HomePerformance, for instance, provides energy audits in British Columbia and Ontario while Alberta Energy Audit provides eco-energy evaluations for both residential and commercial properties located in Calgary.

Continue reading “Home Energy Audits: Government Rebates to Fix up your Home”