Mortgage Brokers are your personal shopper when it comes to mortgages. Brokers will have access to many lenders, each of them servicing a certain type of borrower. Brokers can present your application to the right lender, knowing which one will be a great fit. Using established relationships with lenders and presenting the file to them can save time. Timing is everything in a purchase situation; brokers will present the deal to the right lender to get an approval. Many of the lenders brokers use are only accessible through the broker channel.

Continue reading “Advantages of using a Mortgage Broker”

Author: igill

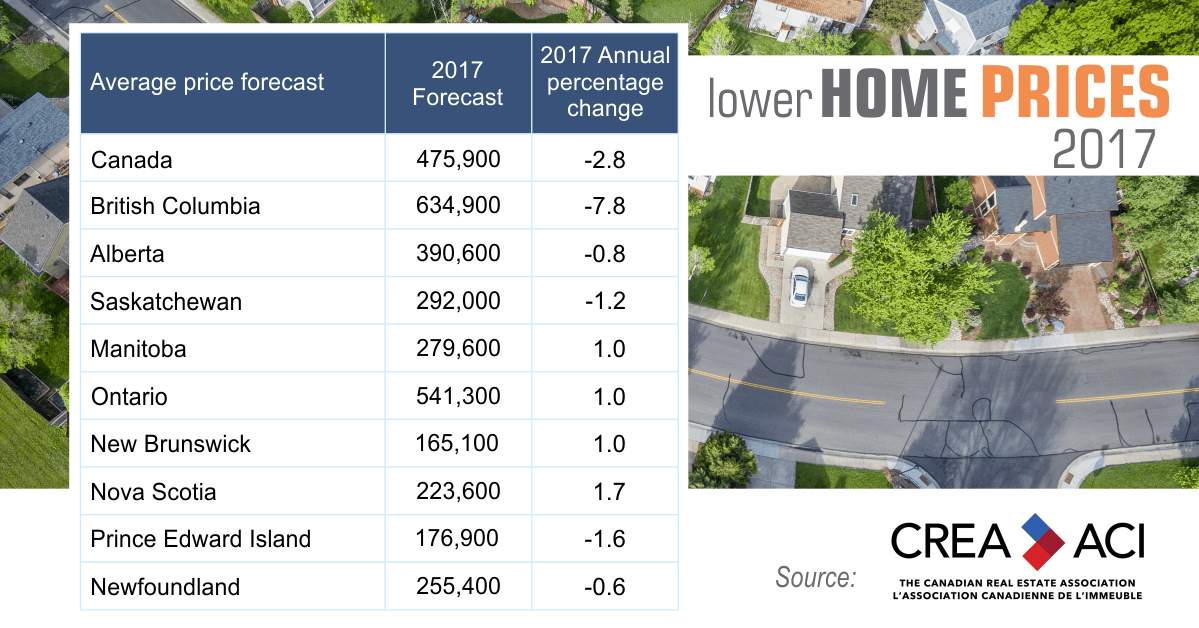

House prices expected to drop in 2017

Canadian realtors are forecasting a price drop across Canada for the first time since 2008. They blame the new mortgage regulations brought in by the federal government in the last quarter of 2016.

Continue reading “House prices expected to drop in 2017”

Longer amortizations…why do they cost more?

With new regulations, insured mortgages have a maximum 25 year amortization. Banks often choose to insure low ratio mortgages, and cover the cost themselves. Having insured mortgages allows banks to off load the risk and securitize these mortgages.

Continue reading “Longer amortizations…why do they cost more?”